Forex can be a real tough place to learn how to trade. Considering majority fail at trading such a structured market (most of the time) and the fact that there are so much misinformation with different agendas. I would like to share some knowledge on what helps me keep a very clear picture of what may or may not happen regarding the “hard right edge”.

Stop Being A Machine Gunner

Before we go any further I would like to help discover the underlying problem of your emotional ass participating in a very serious zero sum game. First of all, I am not going to link you to any article proving that you are emotional, I am just going to use metaphors; you are a damn machine gun. Learn how to be a bolt action sniper rifle. Yes, Forex provides tons of opportunities but it doesn’t mean the odds may be in your favor. This is why you have to be a Sniper, one shot at a time. Remember this: “Patience provides probability”.

How To Be A Sniper

To be a sniper you need to keep several things in mind. This involves your clear objective, trade setup, and what type of market condition you’re in. Here are a few guidelines I follow:

– Market Condition (What type of market condition am I in?)

- Range

- Trend

- Chop

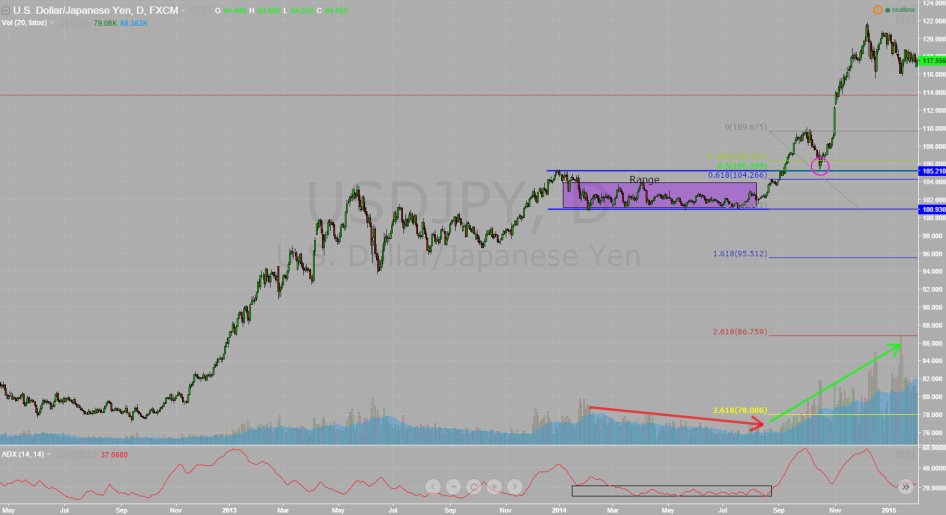

Ranging Market

If you find yourself in a range you can do 3 things:

- Play the edges of the range (top and bottom).

- Wait for a break out and a retest.

- Do Nothing!

Example:

The probability of Patience :

Trending Market

If you have identified that a pair is trending you can do 1 thing:

- Trade in the direction of the trend.

Counter trade the trend.

There were 3 opportunities to enter this potential trend.

a) Enter at the clear bullish break of the Lower High. (“Risky” however more Reward)

b) Enter when a bullish catalyst printed at support. (Pin Bar) (Conservative & Logical)

c) Enter at Indecision printed at support. (Very High Probability)

A “trend” is relative to it’s time frame. The “trend” in the previous two pictures were analysed in the 4-hr time frame. Let’s look at the daily!

“Choppy” Market

I think knowing if the market is choppy or in a clear defined range and/or trend is the second most important skill in trading.

Summary

Staying objective in the market not only keeps your emotion in check; it adds simplicity to trading. In a day and age where indicators may look fancy it’s mostly useless because it’s either lagging or just way off. Remember be a sniper, not a machine gunner. One trade at a time and you will get closer to your financial goals/aspirations. These are just a few examples that happens frequently in the forex market. Understand these 3 market conditions to improve your odds.